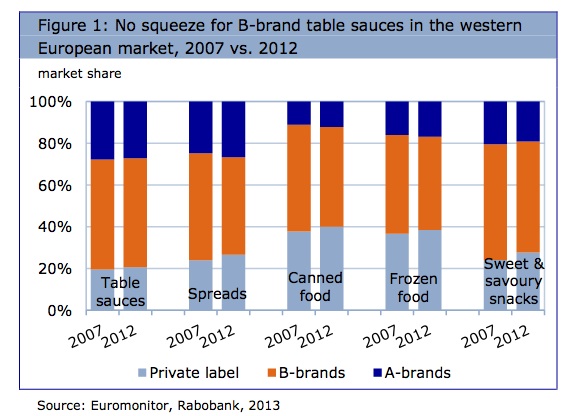

Local table sauces fends off international brands and private label

Local table sauces have bucked the trend among processed food in Europe, by successfully fending off the efforts of both the international brands and private label to grab their market share. However, according to Rabobank’s latest report, this success has come at a price. Manufacturers of local table sauce brands saw operating margins drop nearly 30 percent on average, over the last five years. In contrast, consolidators have managed to improve their results.

Local table sauces have bucked the trend among processed food in Europe, by successfully fending off the efforts of both the international brands and private label to grab their market share. However, according to Rabobank’s latest report, this success has come at a price. Manufacturers of local table sauce brands saw operating margins drop nearly 30 percent on average, over the last five years. In contrast, consolidators have managed to improve their results.

“The market structure of the €5 billion western European table sauce market has been remarkably stable over the past few years, with local brands retaining their market share” explained Rabobank analyst Juliette Kuiken. “However, in such a fragmented market with heavy competition, the average EBIT margin of the manufacturers of smaller, local brands and private label has declined from 5% to 3.5% as retailers were reluctant to raise retail prices despite rising commodity prices.”

Although retail sauce prices have risen by 2% on average most players have not been able to recoup their rising input costs. Prices rose some 7% to 9% per annum for vegetable oils and nearly 2% for sugar.

The diversity of local tastes in Europe has made it very difficult for any one European brand to achieve dominant market share. This market fragmentation limits the potential geographical scope of a brand, and in the case of cross-border consolidation on the supply side, hampers potential synergies.

Heinz is the exception in this regard. As a truly global brand and product, Heinz ketchup is less affected by European taste borders, and as a result has been able to increase its market presence in Western Europe through the acquisition of local brands in France (Bénédicta) and the UK (H.P. Foods), thereby expanding its local retail and distribution networks in these markets.

For the rest of the table sauce market, taste borders do matter and local brands cannot follow Heinz’s example in rolling out their brands to the rest of Europe. However, local or across-the-border mergers are an interesting option. Local brand and private label manufacturers faced with margin pressure can choose to build a larger negotiating party on the supply side, as shown by some local brand consolidators, such as: Remia, Kavli, and Develey. Combined, these consolidators outperformed other local brand and private label producers in terms of improvement in EBIT margin and asset turn.

Rabobank anticipates their example may inspire other local brand manufacturers to follow suit, especially in mature markets, given the generally anticipated inflation and volatility of commodity prices in the coming years. Belgium and the UK provide interesting opportunities for consolidation in particular.

The current consolidators are also likely to opt for other acquisitions, either to strengthen their position in their current markets or to enter a neighbouring country, if relevant and possible given the taste borders.